Unraveling Solana's Staking Ecosystem

A deep dive into how staking works on Solana, exploring the landscape, mechanics and intricacies that underpin this critical aspect of blockchain technology.

The staking ecosystem on Solana is dynamic and constantly evolving- with nearly 67.7% of SOL staked and securing the network. This stake is distributed among ~2380 entities, consisting of independent validators, stake pools, and validators managed by actors such as Centralised Exchanges (CEXes). This article will explore the dynamics of how staking works on a fundamental level, the function of stake pools, compare different staking protocols, and evaluate how SolBlaze fits into this ecosystem.

Understanding the Role of Staking

Before delving into the pivotal role of staking within the Solana ecosystem , it’s crucial to understand some basics regarding the consensus mechanism of Solana.

Consensus Mechanism: Blockchains utilize a consensus mechanism to determine the order and validity of transactions within the latest block.

Proof-of-History: Solana's distinctive consensus mechanism combines Delegated Proof-of-Stake with cryptographically secured timestamps, to establish a chronological order of events on the blockchain.

Validator Participation: Validators, represented by nodes running the Solana client, must deposit SOL as collateral to participate in the consensus/ voting process.

Staking Process: Staking refers to locking up a certain amount of SOL directly with validators as collateral to support the network’s consensus mechanism.

How does the ecosystem benefit from staking?

Individuals earn yield on their staked SOL (based on factors such as the current inflation rate, total SOL staked, etc), as well as other rewards such as additional tokens or airdrops.

Validators accumulate SOL tokens to bolster their voting weight, increasing their likelihood of block production. They are rewarded via commissions and block rewards.

The Network benefits from increased security due to the higher capital requirement to hijack the network and greater decentralization due to the expanded pool of validators supporting the network.

Staking also comes with its associated risks.

Validators are faced with penalties, known as slashing, for incorrect or malicious blocks.

Individuals who have delegated their SOL to a validator that undergoes slashing will incur penalties on their stake.

The different ways to stake SOL

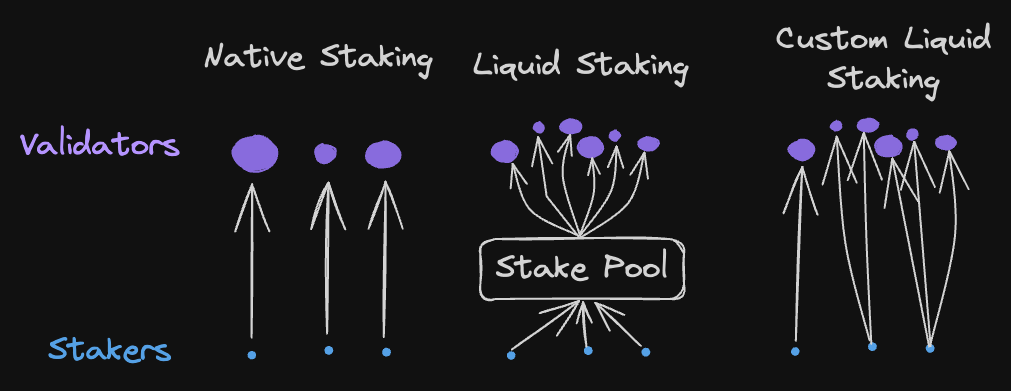

Staking on Solana can be done natively, or via liquid staking protocols.

Manual staking involves significant overhead as individuals must manually select a specific validator from among the 2,000+ options and continuously monitor their performance to ensure consistent rewards. Manual staking also results in popular validators having a disproportionately larger stake, which impedes the decentralization of the network.

In contrast, Liquid staking simplifies this process by leveraging stake pools and delegation strategies, abstracting away much of the complexity involved. Furthermore, Liquid staking addresses a key issue inherent in native staking: The lack of capital efficiency.

When staking SOL natively, individuals effectively lock up their capital and earn a fixed yield (typically 5-7%).

In Liquid staking, users who delegate SOL receive Liquid Staking Tokens (LSTs) in exchange for their staked SOL.

These LSTs can then be utilized in various DeFi protocols, and they have evolved to become a cornerstone of the DeFi ecosystem.

Centralized Exchanges such as Coinbase also provide staking services directly in-app

The tokens are typically delegated to validators operated/selected by the exchange itself, streamlining the staking process for users.

Liquid Staking Protocols in Solana

Solana boasts a vibrant ecosystem of liquid staking protocols, with over 18M in TVL.

Popular Liquid Staking Protocols include:

Marinade Finance

Marinade Finance is Solana’s first liquid staking protocol and provides multiple ways for users to stake. Key aspects of Marinade include:

Liquid staking: Users stake SOL in exchange for mSOL, via interacting with Marinade’s Liquid Staking program.

Marinade Native: A non-custodial solution to allow users to stake their SOL without bearing any smart contract risk.

Unstake Liquidity Pool: A mSOL/SOL liquidity pool to enable instant withdrawal of staked SOL and optimize order matching between stakers and unstakers.

Marinade DAO: An on-chain governance mechanism which allows MNDE holders to vote on protocol decisions.

Jito

Jito integrates liquid staking with the concept of Maximal Extractible Value (MEV) by allocating stake to MEV-enabled validators.

MEV refers to the profit that block producers or validators can earn from including, excluding, or re-ordering transactions in a block.

Spam transactions initiated by entities like Arbitrage bots (in part due to the low transaction fees), lead to network congestion and instability.

Jito runs a fork of the Solana validator client which is optimised for MEV by implementing an auctioning mechanism. Entities submit bundles—sequences of transactions to be executed atomically—in exchange for tips distributed to the validators.

These tips, coupled with block rewards, are then distributed back to the stakers who delegated their SOL to the Jito stake pool.

SolBlaze

SolBlaze supports the Solana ecosystem by delivering a suite of products including BlazeStake, the fastest-growing liquid staking protocol on Solana. The BlazeStake stake pool has experienced a surge of over 1000% in TVL within the last four months.

BlazeStake is a completely non-custodial liquid staking protocol that enables users to stake SOL in exchange for bSOL and delivers high flexibility with its instant unstake feature, allowing immediate withdrawal of staked SOL for a fee.

Distinguished by its expansive validator set exceeding 200, BlazeStake mitigates stake concentration issues prevalent in native staking.

BlazeStake leverages the Stake Pool program developed by Solana Labs, which has been audited and offers high levels of security.

Laine

Laine presents a distinctive approach , operating a stake pool with a single validator.

When users stake SOL, they receive laineSOL in return.

This staking model caters to users who place high levels of trust in a single validator but prefer not to natively stake with them, thus avoiding the locking up of their SOL tokens.

How Liquid Staking Protocols Work

Let’s explore how liquid staking works from a fundamental level, taking BlazeStake as an example. We will explore how BlazeStake utilises the SPL Stake Pool Program, how bSOL derives its value, as well as the delegation strategy used by BlazeStake.

SPL Stake Pool Program

The SPL Stake Pool Program facilitates the pooling of SOL tokens from multiple users into a collective stake account, which is managed by the protocol. By leveraging this program, BlazeStake optimizes the staking process, enabling users to contribute their SOL while maintaining full control and ownership of their assets.

When a user connects their wallet and signs a transaction to stake SOL, a DepositSOL instruction is sent to the Stake Pool Program. This instruction consists of an array of relevant accounts and the specified deposit amount. As the instruction is processed, the following occurs:

Account Validation

The accounts and inputs provided are being validated, including verifying whether they have the appropriate permissions, and ensuring that the correct addresses are being provided. The number of LSTs to be minted for the user is also calculated.

Transfer of SOL

SOL is transferred from the user to the stake account that is managed by BlazeStake via a Cross-Program Invocation (CPI) call to the System Program.

Minting of LSTs

BlazeStake Staked SOL (bSOL) is minted to the token account belonging to the user, via another CPI call to the Token Program.

The amount of bSOL minted for a user in a stake pool is determined by the current exchange rate between SOL and bSOL (Subject to fees & slippage).

Exchange Rate = Total SOL in Pool / Total bSOL supply

Updating of Token Balances

The stake pool tracks the amount of SOL it holds as well as the total supply of bSOL. The bSOL supply is incremented with the quantity that is minted for the user, and the SOL balance is incremented with the amount deposited by the user.

Please note that some details have been omitted to streamline the explanation of the staking process.

Value accrual of LSTs

LSTs such as bSOL are designed to appreciate in value compared to regular SOL over time. But how exactly does this work?

Every epoch (~2 days) validators in the BlazeStake stake pool earn staking rewards in the form of SOL.

These rewards are compounded to the amount of SOL already backing each bSOL token.

Price of bSOL = Total SOL in the pool / Total bSOL supply

As the amount of SOL in the pool grows (while the total bSOL supply remains the same) the price of bSOL (relative to SOL) increases.For any new bSOL being minted, a corresponding amount of SOL (according to the exchange rate) is deposited into the stake pool. This helps to maintain the amount of SOL backing each bSOL.

Stake Pool Delegation Strategies

What happens to the SOL that is accumulated in the stake account managed by BlazeStake? They are distributed across the validators included in the stake pool, via a delegation strategy. This is how BlazeStake selects validators and distributes stake among them. Some key considerations are:

Omission of validators in the security group

The “security group” is defined as the smallest group of unique nodes that comprises ≥ 33% of the total stake on the network. (Currently ~32 validators)

Validators that are part of this group are excluded from the stake pool, ensuring that the network remains decentralized.

Stake Coefficient

The amount of SOL staked to each validator is determined using an index called the stake coefficient. This index is carefully designed using the following metrics:

Annual Percentage Yield (APY): The yearly expected returns from staking with the validator.

Validator score: A weighted average based on crucial performance metrics such as Vote success, skipped slot rate, uptime, and commission)

The novel delegation strategy used by BlazeStake ensures the following things:

Decentralization: Stake is distributed in a way that maximally decentralizes the network, preventing concentration among specific validators.

Competitive Yield: Validators included in the stake pool, generate sufficient yield to be distributed back to users, offering a competitive yield compared to other stake pools. This is evident from a higher stake coefficient provided to validators within the top 75 rankings.

Validator performance recognition: Validator score is a pivotal metric, ensuring that high-performance validators are rightfully boosted with a higher stake coefficient.

Custom Liquid Staking

Native Staking empowers users with full autonomy in selecting their validators, at the expense of locking up their capital. Traditional Liquid Staking, on the other hand, enables users to delegate their SOL to a group of validators without any control over the delegation strategy.

Enter BlazeStake's Custom Liquid Staking Protocol: A dynamic staking mechanism that combines the benefits of both native staking and liquid staking.

Custom liquid staking offers users the freedom to stake their assets with specific validator(s), mirroring the autonomy offered by native staking. Simultaneously, it exchanges their SOL for bSOL to maintain capital efficiency. This option caters perfectly to users who prioritize certain validators but still seek the flexibility and benefits of liquid staking.

Looking forward

The staking landscape on Solana is dynamic and a continuously evolving domain. This evolution is evident from the growth of new staking protocols and innovative mechanisms designed to enhance user experience.

A prime example of this innovation is the Custom Liquid Staking protocol pioneered by BlazeStake. This development is not just an addition to the array of options available for stakers; it represents a leap forward in staking mechanisms only possible on Solana.

As we move forward, we can look forward to more of such innovations will drive the Solana ecosystem towards greater maturity. This evolution will likely usher in more sophisticated and user-friendly staking options, contributing to the overall growth and stability of the Solana network.

References

https://stake-docs.solblaze.org/

https://docs.solanalabs.com/

https://spl.solana.com/

https://solana.org/stake-pools